New at TAC ECONOMICS

Outlook for 2026-2027

A more political, fragmented and conditional global economy

Discover the TAC ECONOMICS scenario and the key risks to watch.

Our analysisCan China avoid the crisis?

Presentation by Thierry Apoteker to the HEC Alumni association on China's outlook and challenges.

Our quantitative tools identify a potential red flag on the horizon for 2027, despite its continued strong appeal in the medium and long term.

Find out moreAfter des réseaux CCI – 10 March 2026

Presentation during the session on "Robustness and resilience in the Eurozone" with a focus on the eurozone recovery, driven in particular by German investment.

See detailsLe Printemps de l'Economie – 17 to 20 March 2026

Participation at the roundtable "How is India, a demographic and geopolitical giant, navigating a world of trade tensions?"

RegisterOur Products and Services

A large volume of economic and financial data and indicators, ratings and forecasts based on TAC models on 150+ countries

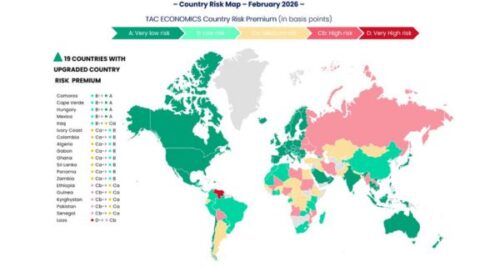

Currency, cyclical, cross-border payment and political risks for 100 developing countries and emerging markets

Macroeconomic analyses and global view, scenarios and economic forecasts, risk analyses and key bifurcation points

A quantitative system to evaluate, anticipate, and manage geopolitical risks with advanced tools.

Currency forecasts for advanced and emerging markets, real-time exchange rate alerts and market analysis

A country risk tool integrating ESG risks with 100 indicators to measure E, S, and G components across 150+ countries

AI-generated early warning signals for equity markets, sovereign and corporate spreads, and reversal risks

Risk assessment of both counterparty risks of individual banks and systemic risks at the country level

Advisory & Consultancy Services

A unique combination of fundamental analysis and advanced quantitative tools

Data Science Projects

We support our clients in developing and deploying innovative solutions for analyzing and managing risks.

Development of AI-driven risk analysis tools leveraging big data and advanced analytics

Design and deployment of AI/ML models for predictive analytics

Implementation of APIs, web applications, and specialized training for data science upskilling

International Development Advisory

We optimize your international growth strategy with our in-depth studies and decision-making tools:

Strategic analyses of countries and sectors

Sectoral/Industry forecasts and benchmarking studies

Identification of opportunities and performance evaluation in target markets

Trusted by the world’s largest banks, companies and asset managers